Town Hall Ventures’ 2026 Predictions

By: Andy Slavitt, Josh Loria, & Andie Steinberg

Last year, we published What THV Sees in 2025—predicting a set of transformational changes for the healthcare system. 2025 largely lived up to that thesis, marked by significant transformation across AI adoption, CMMI activity, and a renewed focus on outcomes and prevention. What’s clear is that many of the forces we flagged have only intensified heading into 2026.

We’re publishing our 2026 outlook with a view of the structural forces shaping the healthcare system over the next year—where policy and technology continue to act as the twin engines of change. Our views are informed by sustained, candid conversations we had across CMS leadership, payors, providers, founders, and technologists. In 2026, we look forward to collaborating across the healthcare ecosystem as these dynamics take shape.

1. ChatGPT becomes the patient front door—and a referral engine for healthcare

We believe consumer-facing LLMs—such as ChatGPT and Claude—will emerge as a major distribution channel for digital health companies, and healthcare more broadly, creating a new growth pathway beyond traditional referrals from health systems, payors, providers, and direct-to-consumer marketing.

The behavioral shift is already underway. For many consumers, conversational AI has become the default starting point for health questions. Some needs will be handled directly by the LLMs, but many won’t. The LLMs will need trusted clinical partners that can accept warm handoffs based on clinical need, geography, and insurance coverage.

That dynamic creates a strategic opening. We expect platforms like OpenAI and Anthropic to integrate referral pathways directly into their interfaces, relying on vetted partners for specific use cases. Over time, this becomes a new distribution channel—AI-mediated referrals—where routing happens natively within the conversation and is supported by API-based intake, eligibility checks, and deep-linked scheduling. For example, a user might ask: “I’m 34, live in Florida, have Medicaid, and I’m feeling depressed”, and receive a direct link within the response to a trusted covered behavioral health provider’s intake flow—reducing friction for patients while increasing qualified referrals for providers.

In this world, advantage accrues to companies that are “AI-referral ready”. That readiness looks less like marketing and more like infrastructure: accurate coverage matching, frictionless intake, clinical appropriateness, trust, and robust APIs for connectivity.

2. Drug costs stay center stage

In 2026, prescription drug costs will remain one of the most persistent and consequential focal points in healthcare policy, with pressure coming simultaneously from regulation, market dynamics, and the innovation pipeline.

Policy momentum is reinforcing this trend. Additional rounds of IRA drug price negotiation are rolling out, underscoring that price compression is not a one-time intervention but a sustained direction of travel. The most recent batch—covering 10 additional drugs with reported average price reductions of ~35%—signals bipartisan durability. In parallel, international developments point to early signs of “global cost burden sharing” for pharmaceutical innovation. Reports that the UK is moving to increase net prices for new medicines (~25%+ increase) highlight growing recognition that the U.S. has long borne a disproportionate share of global pharmaceutical R&D costs—reinforcing MFN-style policy thinking around global cost burden sharing. Expect more announcements like this.

Cost pressures are intensifying as the FDA pipeline tilts toward high-cost modalities like cell and gene therapies (C>s), and as GLP-1s demonstrate substantial clinical benefit across expanding indications. As discussed later in Prediction 7, GLP-1s are especially influential because they move outcomes policymakers care about—such as A1c, BMI, and cardiometabolic risk—which are directly rewarded in models like ACCESS.

We expect continued growth in specialty drug carve-outs, including for GLP-1s, alongside increasing consumer and employer interest in alternative access pathways, including cash-pay, as stakeholders search for relief from rising pharmacy spend. Direct-to-consumer and cash-pay pharmacy models are expanding access and reshaping patient expectations, particularly as AI-enabled prescribing and clinical decision support move closer to the point of care (see Prediction 9).

Pharmacy is no longer a downstream function; it is increasingly central to how care is accessed, navigated, and paid for.

3. Medicare changes risk-adjustment again… beginning in 2028

We predict CMS will announce, by the end of 2026, a structural shift away from documentation-driven coding intensity (RAF) and toward a new CMS-standardized inferred risk aided by AI. Under an inferred-risk approach, expected cost would be derived statistically at the population level using claims data, pharmacy utilization, and ideally deeper clinical signals—rather than relying solely on annually documented diagnoses. This transition won't occur in 2026, but we expect the direction to be clearly signaled, with 2027 likely the last year of relative stability under the current model before a new model is launched in 2028.

Billions of dollars of revenue will shift in ways that are deliberately harder to game—and that’s the point. When inference is applied consistently across the population, individual coding advantages will matter far less. Artificial variance driven by who can “out-code” whom flattens, and in the best case, this approach is harder to game, better aligned with policy goals around choice, competition, and protecting taxpayer dollars, and reduces the burden on clinicians.

4. Medicare Advantage shifts to become the most stable risk pool in a destabilized system

After upheaval in the Medicare market over the last few years, Medicare Advantage (MA) is stabilizing just as other government risk pools begin to wobble. Medicaid and the ACA Exchanges face growing volatility as OBBBA-era redeterminations accelerate churn and shift acuity, straining state budgets and MCO economics. At the same time, affordability pressures—especially around ACA subsidy expiration—add uncertainty in Exchange enrollment and risk composition.

By contrast, MA is entering a period of relative clarity. 2026 marks the first year that the disruptive effects of the V28 risk model phase-in have fully worked through plan economics, and, as we had predicted, CMS finalized a 5% average increase in MA payments—more than $25 billion above 2025 levels, materially higher than recent years. Looking ahead, we expect upward rate pressure to continue into 2027, with CMS likely approving an even higher payment increase as benchmarks are further aligned with sustained utilization and unit cost trends.

The levers needed for performance are changing. As rates improve and the V28 uncertainty fades, accountability rises: plans will be expected to demonstrate real health improvement through care management, clinical pharmacy integration, access expansion, home-based touchpoints, and consistent operational execution—not just documentation excellence.

5. Medicaid enters an actuarial reckoning

Medicaid is entering a period of acute uncertainty over the next three years, driven in large part by OBBBA-era dynamics. Work requirements and their downstream effects will reshape risk pools in ways that existing rate-setting frameworks will have a difficult time keeping up with. As acuity shifts and membership turns over more rapidly, actuarial soundness and rate adequacy move to the center of the debate.

State rate-setting methodologies are increasingly struggling to keep pace. Variation across actuarial firms and states compounds the problem: some rely on short lookbacks that amplify volatility, while others use multi-year windows that lag rapidly changing risk. With CMS largely limited to approving or rejecting state submissions, actuarial approaches at the state level must price for the changes in the underlying risk pool.

Plans that cannot secure adequate rates can pull back, reduce benefits, or tighten networks if competitive dynamics allow. Providers will feel the pressure through lower reimbursement and higher bad debt. States will face an increasingly difficult tradeoff between near-term budget control and long-term program viability.

In 2026, the advantage accrues to organizations that can work closely with states to navigate this volatility and provide credible actuarial analytics.

6. Sub-capitation scales from the new ACO flagship model (LEAD)

From Pioneer to NextGen to REACH, CMS’s flagship ACO model now evolves again: ACO REACH sunsets in 2026 and will be replaced by LEAD—a structural redesign with many benefits, not a retreat from two-sided risk.

The most consequential change, and your new acronym of the year, may be CARA (CMS Administered Risk Arrangements). Under REACH, downstream risk transfer largely failed—fewer than ~4% of payments flowed to specialists under capitated or episode-based arrangements, leaving most care delivery effectively fee-for-service despite nominal two-sided risk. CMS aims to address this by providing CMS-managed data sharing, standardized episode definitions, configurable episode design, and CMS-administered payment mechanics.

LEAD also materially de-risks participation. The model introduces 10-year benchmarks with no rebasing, improved high-needs benchmarking, and prospective infrastructure payments for rural providers, alongside lower alignment thresholds for new entrants. These changes directly address the volatility and cash-flow concerns that historically kept rural, independent, and safety-net providers out of ACO models.

The implication is a step-function change in how population risk is executed. Sub-capitation starts to become a reality rather than an experiment. The winners will be those that can align high quality specialists, manage episode economics, and deploy technology that supports attribution, performance tracking, and reconciliation at scale.

7. Medicare’s first AI-native CMMI model (ACCESS) sets a new template for chronic care management and boosts GLP-1 use

CMMI’s ACCESS model (Advancing Chronic Care with Effective, Scalable Solutions) marks Medicare’s acknowledgment that chronic care is best managed through continuous, technology-enabled support—not episodic visits to a doctor’s office. Over the past several years, healthcare AI innovation has accelerated, with companies deploying agents that coach patients, support adherence, navigate care, and meaningfully augment clinicians. The persistent constraint has been payment: no broadly applicable CPT code has mapped cleanly to these services.

ACCESS begins to resolve that mismatch. Like RPM and CCM a decade ago, it creates a scalable reimbursement pathway for technology-enabled care—but with a critical distinction: payment is aligned to outcomes, not activity or time logged.

ACCESS puts pressure on legacy RPM and CCM structures, which we expect to gradually phase out as policymakers favor models that reward measurable improvement over utilization. If the economics prove durable, ACCESS could open a clearer path toward outcomes-aligned PMPMs that support care models built around coaching, navigation, adherence, and longitudinal engagement. For providers, ACCESS creates an economic incentive to partner with digital capabilities such as behavioral health integration, digital therapeutics, remote monitoring, and between-visit engagement.

ACCESS KPIs such as A1c or BMI are directly influenced by GLP-1 use, and behavioral health measures rely on patient self-reporting. At the same time, ACCESS introduces a clear forcing mechanism through the Substitute Spend Adjustment, which disallows duplicative services—such as RPM or CCM for the same condition—billed elsewhere during the care period. This signals CMS’s intent for ACCESS to replace, not layer on top of, legacy volume-based chronic care programs as Medicare shifts toward reimbursing outcomes rather than process.

8. The Administration’s prevention agenda shifts Stars from process measures to outcomes

In our 2025 outlook, we argued that healthcare would move from measuring activity to measuring improvement. CMS’s recent CY2027 proposed rule confirmed our prediction from last year. The proposal would remove 12 Stars measures focused primarily on administrative processes, with the explicit goal of rewarding outcomes, not process measures.

These changes are incremental, but their significance lies in what they signal. We believe they foreshadow a significantly larger shift toward embedding outcomes and prevention directly into Stars in a way that materially changes plan behavior. The MAHA framing reinforces this direction by elevating prevention and measurable health improvement as policy priorities. While CMMI’s MAHA Elevate initiative is directionally aligned, its limited scale—$3 million in grants to a small number of organizations—makes it unlikely to drive population-level change on its own. Stars, by contrast, is one of the few levers powerful enough to operationalize prevention across Medicare.

9. Administrative AI consolidates—clinical care is the next frontier

AI is the most consequential healthcare technology development—even including the EHR. 2025 marked a year of rapid adoption, with much of that uptake resulting in a payor vs. provider “arms race”. Buyers piloted point solutions quickly, often outside formal RFPs or a unified platform strategy. Open budgets, accessible APIs, and abundant venture capital made this an unusually favorable environment for healthcare AI startups. Higher-quality AI platforms will emerge—tools that reduce friction rather than add to it—as consolidation gives rise to mega-AI companies such as Thoreau.

At the same time, AI’s center of gravity will shift into clinical care. Beyond administrative automation, 2026 will see AI directly augment clinicians—supporting assessment, decision-making, prescribing, and longitudinal care amid workforce shortages. The market will move from primarily diagnostic use cases toward therapeutic and workflow-embedded systems of action, including mental and behavioral health agents, adherence support, and care delivery.

In an increasingly crowded marketplace, distribution will matter as much as product in determining market winners.

10. ACA subsidy expiration and employer cost pressure put coverage affordability back on the ballot for midterms

We expect healthcare coverage affordability to become a material issue in the 2026 midterm elections. Market forces across the ACA Exchanges and employer-sponsored insurance now converge on tens of millions of voters, pushing healthcare cost and access back onto the kitchen-table agenda. Rising premiums, higher deductibles, and visible coverage instability elevate healthcare from a policy debate to a lived economic concern heading into the midterm cycle.

At the center of this shift is the expiration of enhanced ACA subsidies. Early indicators suggest growing price sensitivity and churn risk. These dynamics point to a pronounced mix shift toward Bronze plans, a sicker risk pool, rising underinsurance, and eventual increases in uninsurance.

As people churn off Medicaid or Marketplace coverage, they reappear in emergency departments and hospital balance sheets. Uncompensated care and bad debt will rise, particularly in states hardest hit by redeterminations and subsidy roll-off. Health systems will seek relief through higher commercial rate negotiations. Layer in continued growth in specialty drug spending (ex: GLP1s and C>s per Prediction 2), and employer healthcare cost trendlines will continue to climb. With roughly 150 million Americans covered through employer-sponsored insurance, employers feel the heat in a way that bites into wages—giving this dynamic real political weight heading into the midterms.

As we predicted last year, ICHRA adoption remains modest (~500k lives to date) and we don’t expect that to change in 2026.

At Town Hall Ventures, we view this as a period of structural reset. These are moments when enduring healthcare companies are built. Medicare is demanding outcomes. Employers are demanding relief. AI is full of promise. Consumers are demanding affordability that actually works. We’re excited to partner with the founders and operators prepared to meet this moment and help build a healthcare system that delivers better outcomes and durable value.

We can be reached at steinberg@townhallventures.com.

Town Hall Wrapped | 2025

2025 marked a year of significant shifts across healthcare, driven by changes in policy, capital markets, and the accelerating pace of technology adoption. In this environment, Town Hall doubled down on our core approach: thematic research grounded in policy, deep operational engagement with our companies, and a focus on AI and technology as fundamental drivers of healthcare transformation.

We view AI not as a point solution, but as an infrastructure layer—capable of reshaping how care is delivered, medications are accessed, patients are engaged, and payments are managed, all at meaningfully lower cost. Over the past year, adoption of AI across our portfolio expanded rapidly, with companies embedding these capabilities directly into their operating models to improve outcomes and unit economics at scale.

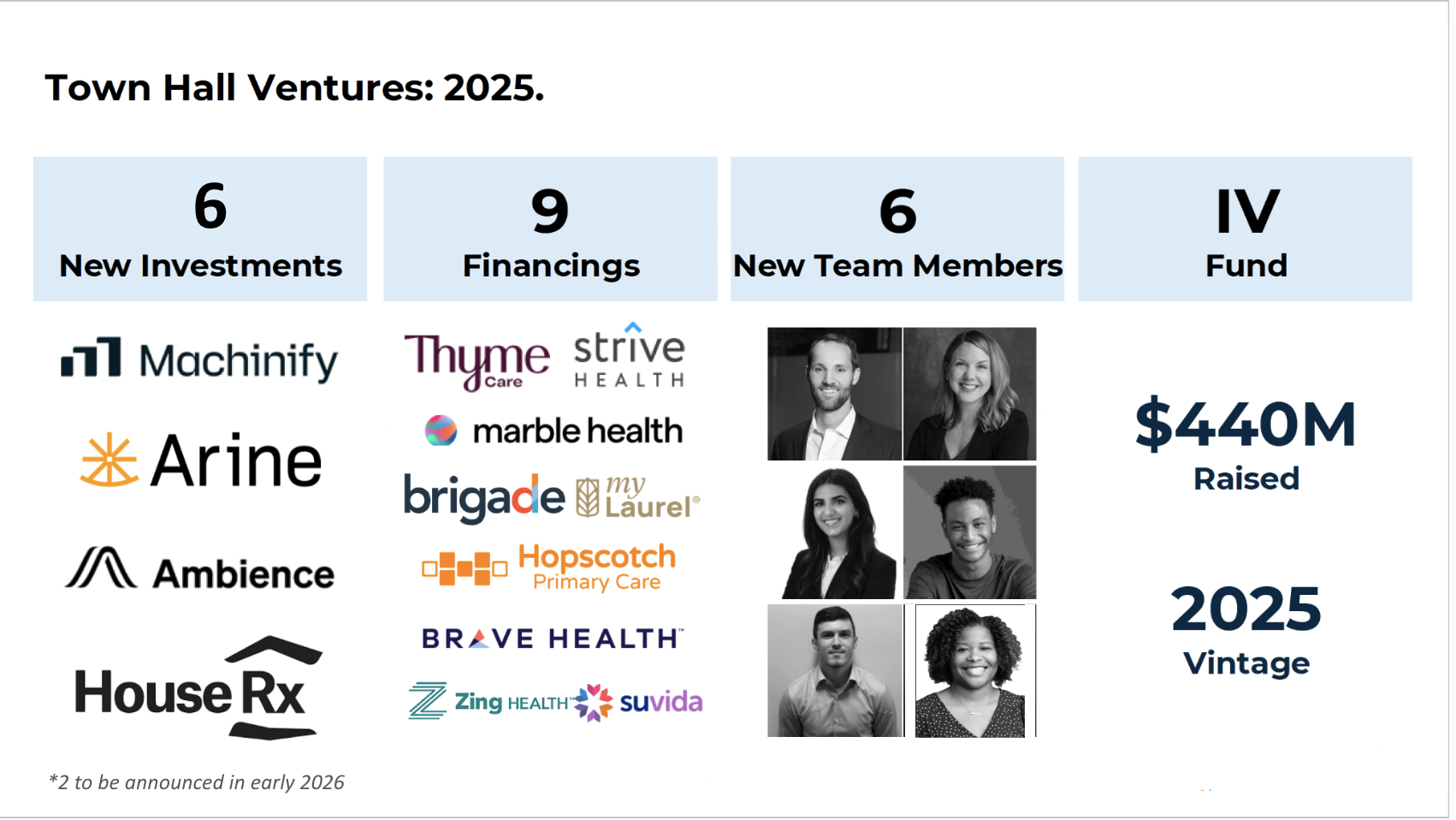

This perspective has shaped how we invest. In October, we were proud to announce the launch of Town Hall Ventures Fund IV, and we are deeply grateful to our limited partners for the trust you have placed in us to deploy this capital. As we put Fund IV to work, we are prioritizing companies where AI is a primary enabler—embedded in the core operating model and tied directly to better outcomes and unit economics.

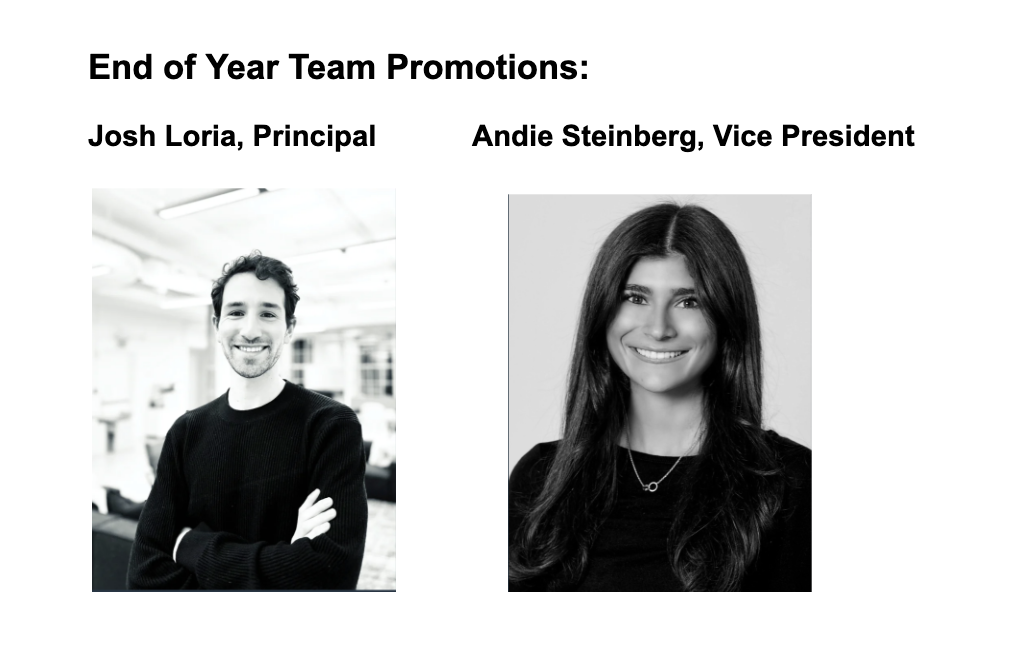

As a firm, 2025 marked a year of meaningful progress. We made six new investments (two of which are expected to be announced early in the new year), the final three from Fund III and first three out of Fund IV, saw nine portfolio companies complete financings, welcomed six new team members, and saw another liquidity event out of Fund I. We saw billions of dollars of ecosystem commerce, with Limited Partners continuing to show enthusiasm for and investment in partnerships with Town Hall portfolio companies.

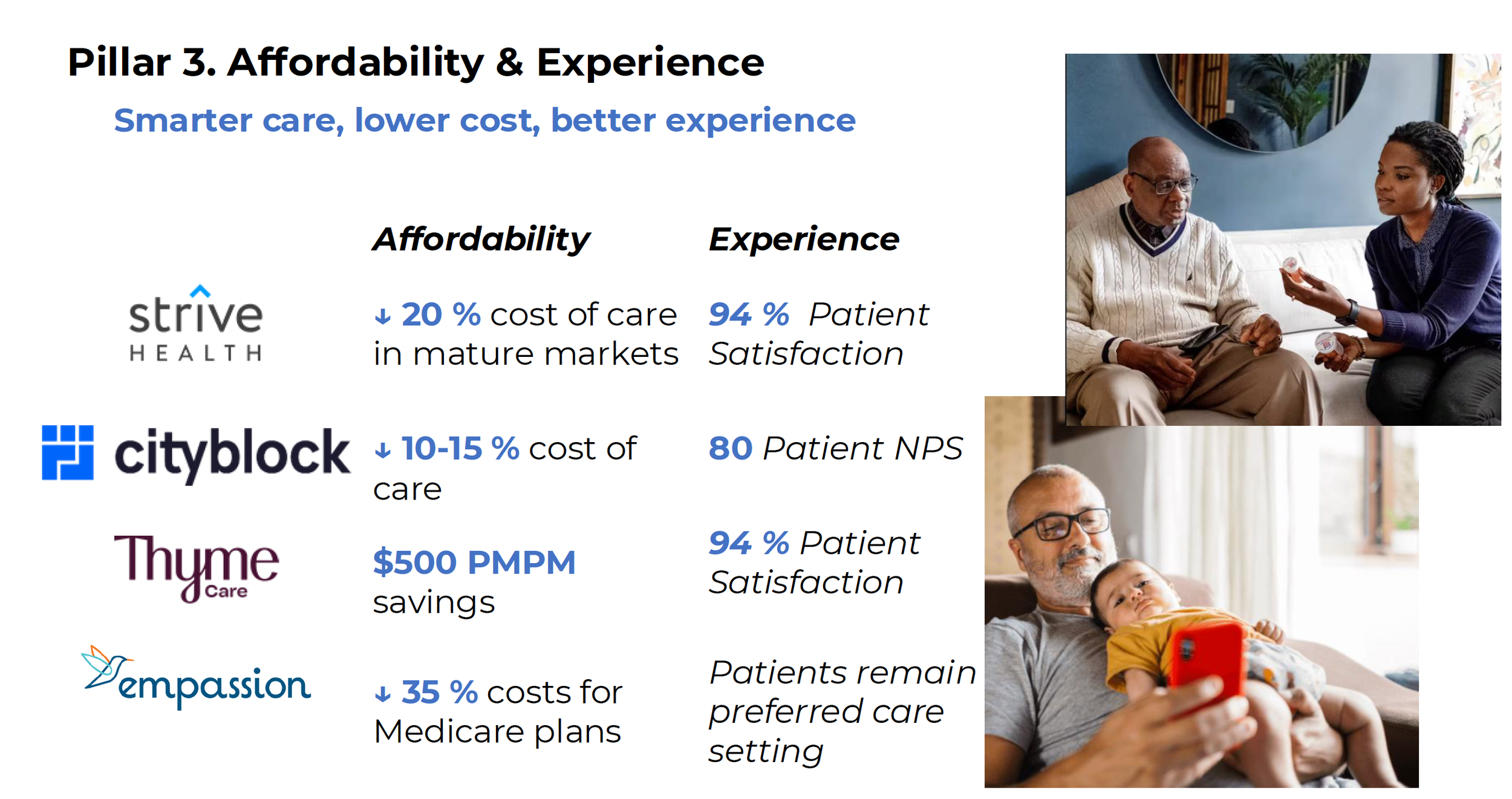

Across the portfolio, we saw Strive Health and Thyme Care each complete significant fundraises while continuing to scale technology-enabled specialty care in kidney and oncology, respectively. Hopscotch Health advanced critical work influencing how states deploy Rural Transformation Fund dollars, helping shape the future of rural care delivery, and Habitat Health emerged as the fastest-growing PACE plan in the country. We were proud to see Qualified Health recognized on the CB Insights Top #DigitalHealth50 list at HLTH for its AI platform enabling health systems to safely scale AI with governance and clinical safeguards, and Ambience recognized by KLAS as the #1 tool improving clinician experience in the emerging solutions category - garnering a 97.7% customer satisfaction score. We continued to deepen our pharmacy thesis through new investments in HouseRx and Arine, where AI is reshaping medication access and management.

Policy remains a central pillar of our strategy. Since the Annual Meeting this fall, CMS has advanced several important innovation models, including ACCESS, LEAD, and BALANCE, reinforcing a shift toward outcomes-based payment and prioritization of chronic illness prevention and control. Our proximity to these developments allows us to stay ahead of where incentives are moving—and to invest + guide portfolio companies accordingly.

This year also marked the launch of the Town Hall Impact Advisory Council, composed exclusively of LPs who volunteered their time to help guide how we measure, govern, and report the impact our companies are having in the years ahead. We are grateful for their leadership and partnership.

Below, you’ll find more detail on the year—and the year in pictures. Thank you for being part of this work.

Wishing you and your families a Happy New Year!

— The Town Hall Ventures Team

See our year in pictures THV 2025

By the Numbers:

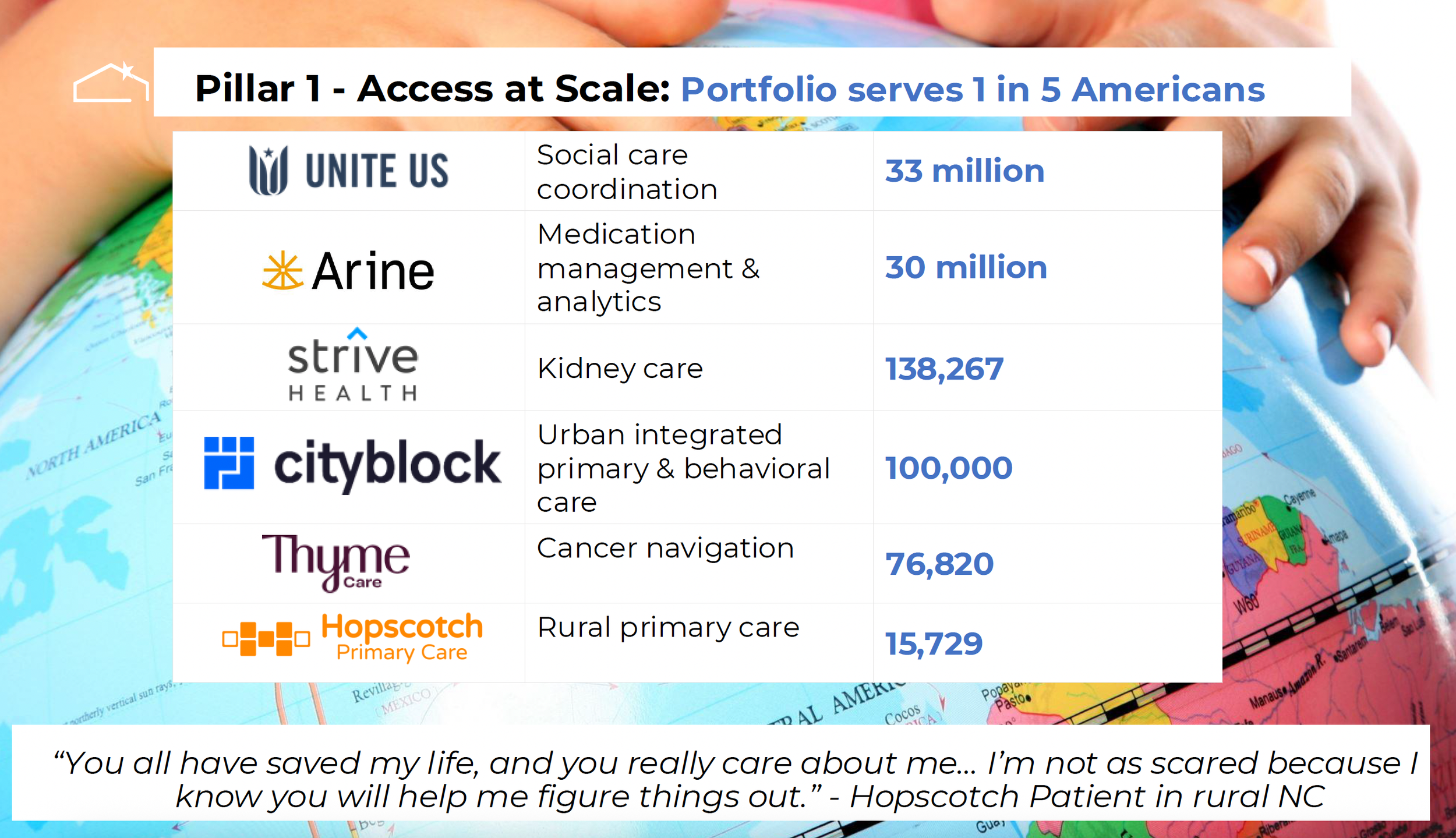

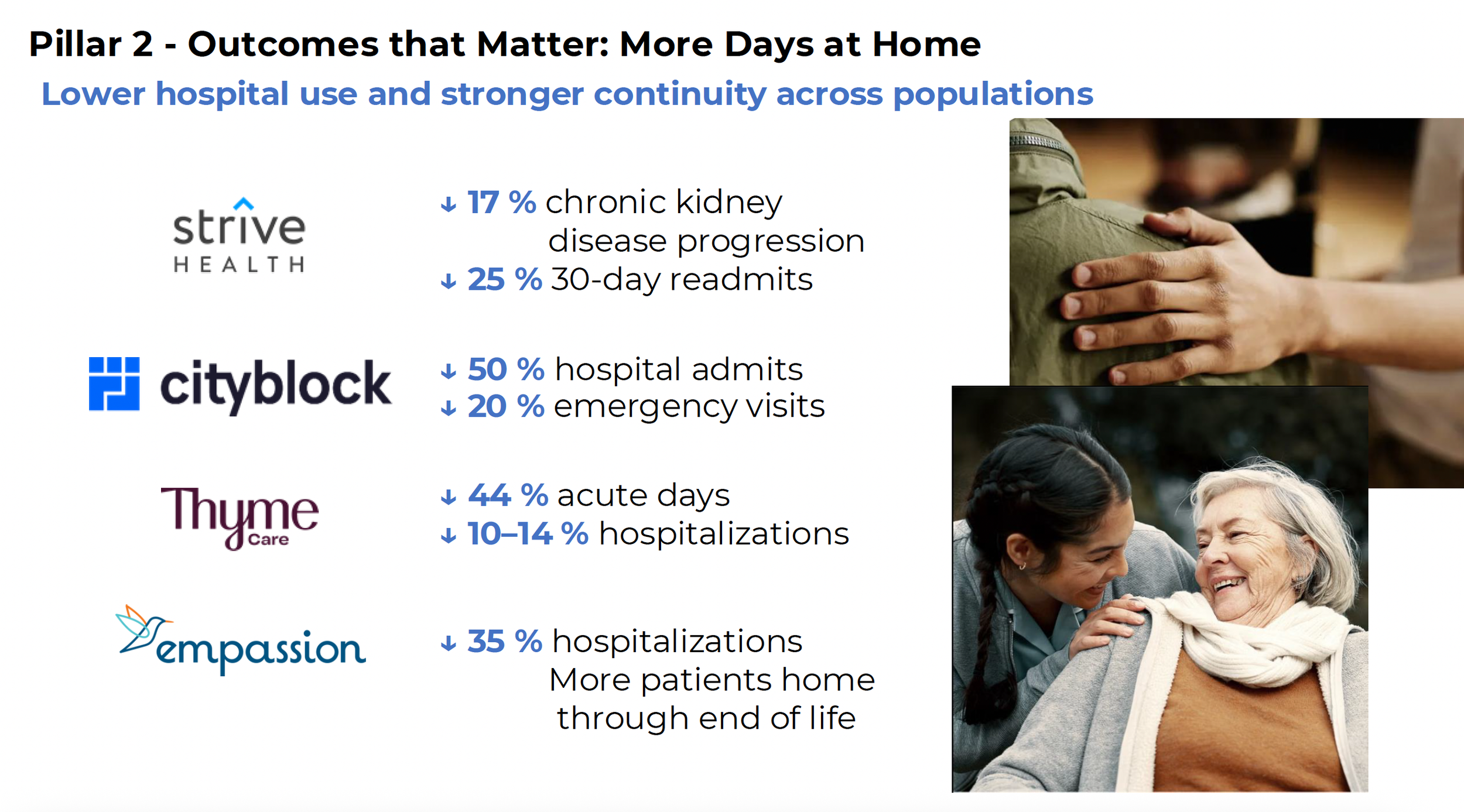

Select Portfolio Impact Metrics:

From Prescriptions to Patients: How AI Is Redefining the Medication Experience

Getting and paying for prescriptions is one of the most frequent—and fraught—experiences Americans have with the healthcare system. Nearly half of Americans with chronic conditions don’t take medications as prescribed, leading to over half a trillion dollars in avoidable costs and more than 100,000 preventable deaths each year.

Last year, Town Hall Ventures set out to find companies reimagining the role of pharmacy within the continuum of care. That exploration was shaped by shifting policy and market forces—including drug pricing reforms under the Inflation Reduction Act (IRA), rising specialty spending, new therapies, and advances in AI. After 7+ years of backing care models for underserved communities, we’ve seen that illness management doesn’t stop at the clinic; it continues at the pharmacy counter and in the home—where medications are started, stopped, or simply never taken. We believe those who bridge clinical and pharmacy workflows using technology, empathy, and data can drive better care. This year, we made two new investments reflecting that belief:

Pharmacy is a Core Pillar of Value-Based Care

For years, value-based care innovation focused on new models in primary care, virtual care, or home-based services. These models have assumed that providers could manage medications, but clinicians remain overwhelmed and under-supported. For too long, pharmacy has sat downstream of care delivery—treated as a fulfillment function rather than a clinical partner —undermining even the most sophisticated care delivery models.

We believe the next generation of companies will blur that line—embedding medication access and optimization into the heart of patient care — enabling tighter coordination, better adherence, and lower costs. Pharmacists—both human and AI-driven—become part of the care team, with technology integrating their workflows and giving providers the tools to guide patients from prescription to fulfillment to follow-up. When care delivery and pharmacy converge, incentives align, outcomes improve and costs decline. This convergence is fast becoming a core pillar of value-based care.

AI as a Bridge Between Care Delivery and Pharmacy

Town Hall Ventures’ pharmacy thesis starts from a simple truth: adherence is not a patient behavior issue—it’s a system design issue. The solution lies in integrating pharmacy into care delivery so that medication management is proactive, coordinated, and data-driven.

Sophisticated platforms—powered by AI—can ease the burden of rising polypharmacy, prescription access, and complex coverage rules by optimizing medication decisions and specialty dispensing at scale. AI can now flag drug interactions, suggest cost-effective alternatives, and automate time-consuming processes like prior authorizations. With new federal policies demanding price transparency and affordability, and with AI tools automating the most manual parts of pharmacy operations, the system is being rewired around what matters most: patients actually getting—and taking—the life-saving and health-preserving medications they need.

Two Town Hall Ventures portfolio companies—Arine and House Rx—are bringing this vision to life.

Arine: AI-Driven Medication Optimization

Arine is an AI-powered medication intelligence platform that helps payors and at-risk providers optimize drug regimens safely and cost-effectively. Arine identifies risks, flags adherence issues, and recommends prescriber-level interventions.

By influencing prescribing behavior in areas like complex chronic disease and behavioral health, Arine reduces avoidable complications. Co-founder and CEO Yoona Kim, PharmD, PhD, brings a pharmacist’s perspective to the product, building the platform in close collaboration with customers. Its modular platform supports outcomes-based contracts and Medicare Part D risk management & quality measures, making Arine a strategic partner for payors navigating Medicare and Medicaid pharmacy dynamics.

With Arine…

Providers act on 50% of AI-surfaced recommendations—a remarkably high adoption rate

Customers see reduced hospitalizations by up to 40% among patients with medication-related risks

Risk-bearing entities achieve a 10% reduction in total cost of care

Serving more than 30 million patients across dozens of risk-bearing entities, including many of the nation’s largest health plans, Arine is building the playbook for how to optimize medications in a value-based world. Arine demonstrates how AI can augment—not replace—clinical intelligence and turn medication management into a measurable performance lever.

House Rx: Pharmacy-In-A-Box

While Arine tackles medication optimization at the population level, House Rx is redesigning where and how specialty pharmacy care happens. Its technology embeds pharmacy services directly into provider practices, enabling clinics to operate their own in-house specialty pharmacies with world-class efficiency.

By integrating into practices’ EHR workflows and aligning prescriber-pharmacist coordination, House Rx brings medically integrated dispensing—historically reserved for large provider groups—within reach for independent clinics in an operationally seamless and financially viable way. At the heart of House Rx’s solution is a full-stack cloud platform that streamlines the entire specialty medication lifecycle powered by AI, not armies of staff—from prior authorizations and benefit verification to patient financial support, dispensing, and ongoing monitoring.

With House Rx…

Patients start medication therapy in an average of 3.5-days (80% faster than industry norms)

Providers complete prior authorizations in minutes instead of days, freeing 20 + hours per week for clinical staff. Also, these practices no longer rely on fragmented, payor- and PBM-owned pharmacies that can put profit before patients

Payors see mid-80% medication adherence rates, well above national benchmarks

Specialty drug spend now exceeds $300 billion annually, yet much of it fails to deliver value to patients. House Rx is changing this by proving that high-touch, tech-enabled models can dramatically improve both the economics and experience of specialty care.

Our Investing Approach: AI-Powered Pharmacy Services Unlock Value Across the Care Continuum

Whether through population-level analytics or clinic-level integration, this new class of AI-powered pharmacy services is making it easier for prescribers to get patients on the right medication at the right time by reducing friction, improving coordination, and aligning pharmacists, prescribers, and technology. The result? Faster time to therapy, reduced administrative burdens, and better patient outcomes.

Pharmacy-integrated services transform the pharmacy from a black box into a collaborative extension of the care team. Town Hall Ventures sees enormous potential in innovators bringing pharmacy out of its silo and into the center of patient care.

As we have shared before, AI has the potential to redefine healthcare operations—what we call “healthcare services as software.” That includes pharmacy, where analytics anticipate risk, no patient falls through the cracks, and access to life-saving therapy is frictionless. Achieving this “Scripts-to-Solutions” vision will require deep collaboration across providers, payors, pharmacists, technologists, and investors. This philosophy shapes our investment strategy: back innovations that transform areas of inefficiency—like fragmented, unmanaged pharmacy spend—into engines of value to redefine what’s possible for patients, providers, and the system at large.

At Town Hall Ventures, we’re proud to partner with companies, like House Rx and Arine, leading that transformation. Integrating pharmacy and leveraging AI isn’t a “nice-to-have”—it’s mission-critical for the future of healthcare.

ANNOUNCING TOWN HALL VENTURES’ FUND IV: INNOVATING FOR BETTER HEALTH OUTCOMES OVER THE NEXT DECADE

It all begins with an idea.

By Meera Mani, MD, PhD, General Partner, Town Hall Ventures

Town Hall Ventures announced today that we have begun the investment period for our fourth and largest fund, a $440 million vehicle that will allow us to continue our mission of transforming how healthcare works for the people and communities too often left behind, while generating exceptional returns.

For the last eight years, Town Hall Ventures has invested behind incredible founders who have led important paradigm shifts in healthcare, across areas like cancer care, Medicaid, rural health, clinician productivity, and senior care. We believe the next few years will bring even more significant opportunities as a wave of technology breakthroughs - therapeutics, diagnostics, smart devices, and of course generative AI - fundamentally reshape US healthcare. And unlike the past decades where healthcare was slower to realize productivity gains from innovations as compared with other sectors, the rising cost of employer-sponsored healthcare, large reductions to Government healthcare expenditure, and labor shortages are creating a ‘burning platform’ for change.

Given this context, we think that those who believe that the venture model is not compatible with improving healthcare for underserved communities are simply missing the point.

There are vast whitespaces and durable moats - in primary care, home care, managing medications, and in modernizing healthcare infrastructure - if you know where to look. And if you know how to connect the best payment model with the best AI-native business model, and align with policy tailwinds. As healthcare sector specialists, this is what we do. Through our Fund IV, we are excited to partner with the best technologists and product builders who want to apply the venture model to make a difference. Healthcare is often described as notoriously hard to break into. We hope to make that easier, in collaboration with our enthusiastic ecosystem of partners, which include health systems, community health centers, health plans, and Government leaders.

The next decade may well be the most dynamic one we have seen in healthcare for my generation. It is a responsibility and privilege in this moment to ensure that the innovations reduce inequities rather than expand them.

Read more here about our thesis on AI in healthcare services and here for the Forbes story on Town Hall Ventures Fund IV.

AI x Care Delivery: Healthcare Services as Software

By Andy Slavitt, Dr. Meera Mani, and Josh Loria

Generative AI uptake in healthcare has been a stunning contrast to other technologies, including EHRs, with 66% of physicians utilizing generative AI tools in 2024 – nearly double the number that used them in 2023. This exponential adoption in an industry notorious for slow adoption of new paradigms and limited labor productivity gains for decades indicates that generative AI has the potential to rapidly rewire healthcare in the coming 2-3 years. By providing healthcare services via software, which has an exponentially lower cost to serve, AI can help shift care delivery from being cost prohibitive to financially sustainable. This is especially true in the government funded programs of Medicare and Medicaid. Everything from how the healthcare system interacts with patients, the resources providers use to make clinical decisions, and what “value-based care” actually means – is being impacted.

This is why Town Hall companies, collectively serving 4 million Americans across the country, are embracing this technology. These companies are using AI to accelerate their growth and do so in a much more capital-efficient way – deploying multiple AI use cases across clinical and administrative areas. Here, we describe how gen AI is reshaping care delivery – and how care providers who implement it improve patient satisfaction, access to care, and margin.

How generative AI is reshaping care delivery

Today, the technology and processes that power care providers are centered around data storage and administration. Technology, including EHRs, e-prescribing, and revenue cycle management tools, has provided modest but highly variable benefits in health outcomes and productivity. Gen AI can change this status quo.

1. Ambient documentation platforms are becoming the “co-pilot” for provider <> consumer interaction

What it is: As ambient listening and documentation of healthcare conversations becomes widely adopted across languages, these vendors are beginning to take on pre-, during-, and post-visit activities for both clinical and non-clinical interactions.

Before visits, medical co-pilots can prepare chart summaries highlighting relevant context for the visit – and can assist in hand-off between different team members (e.g., nurse shift changeover in inpatient settings)

During visits, they make it easy for providers to accurately document clinical conditions, address patient issues, and close care gaps – all while bringing back greater eye contact and engagement between the provider and the consumer

After visits, these tools audit charts, provide accurate documentation for timely billing and authorization of future care, and handle follow-up care interactions with patients

One Town Hall portfolio company, Cityblock Health, is freeing up valuable care team time by utilizing AI to automated assessment completion and member outreach. Another, Thyme Care, is using AI to conduct quality assurance and quality control (QA/QC) on care team interactions, ensuring that members see a consistent experience that maps closely to best practice clinical guidelines.

Why it matters: Ambient data capture is already creating a meaningful productivity boost – scribes save physicians up to an hour a day. Now, co-pilots can expand into adjacent areas – reducing delays and inefficiencies in the care process.

2. Agents, agents, agents (+ robotic process automation)

What it is: Robotic process automation (RPA) handles rules-based, repetitive activities – like copying data from clinical systems into care management platforms or billing systems. AI agents, on the other hand, can learn and infer from context – and independently complete complex tasks like drafting tailored prior authorization appeal letters citing clinical evidence from chart notes.

Patient-facing voice and chat agents are already taking on common administrative activities such as scheduling and sub-clinical activities like remote patient monitoring; other agents are automating interactions with payors to handle routine activities in key areas like claims submission. We expect to see the scope of activities widen as many of the underlying foundation models improve, the depth of training data for common activities grows, and compute cost falls.

As an example, Zing Health, a special needs insurance plan focusing on diabetics in under-served communities, is using AI voice agents to conduct health risk assessments (HRAs) directly with new members, providing flexibility to the members (e.g., the HRA can be done at any time of day) and operational leverage for Zing.

Why it matters: For the last 3 decades, software has helped knowledge workers automate their work to deliver services more efficiently. With agentic AI, that paradigm is flipped on its head – rather than software helping humans complete a task, software is completing previously human-dependent tasks itself. Instead of talking about “software as a service,” we’re talking about “services as software.”

3. The “AI doctor”

What it is: The question many have is when can the co-pilot fly at least part of the flight. As AI models train on real-world data, as the interactions become more human, and as humans show increasing comfort interacting with avatars, many of the tasks clinicians currently perform will, in fact, be completed using technology. Bill Gates, in a recent interview, predicted that we won’t need humans “for most things” including “great medical advice” in the near future. While anything is possible in 10 years, we are better positioned to look at what we see as possible over the next 2 years. Town Hall and our portfolio companies are focused on the 150 million Americans who lack access to basic primary care, specialists when they need them, and high quality care management programs to manage chronic disease; it is against that backdrop that we see technology allowing greater care access for all Americans.

More and more sub-clinical and clinical activities will be directly delivered AI-to-patient as the AI<>patient interface improves, consumer comfort grows, and appropriate human-in-the-loop guardrails are developed. Expect to see this first deployed for narrow, protocol-defined conditions or pathways like diabetes and tasks like medication and prescription management. First line triage, diagnostics, and treatment applications, along with ongoing care management, are not far behind. Many jobs for AI are critical activities that physicians and their teams have not had adequate time to manage as panel sizes and waiting lists ballooned. Expect to see AI’s clinical scope expand meaningfully in the coming 12-24 months.

Why it matters: 60% of community health centers report difficulty obtaining new patient specialty visits for Medicaid patients; access and affordability challenges persist for the neediest Americans. The AI doctor can outperform the average human doctor at near zero marginal cost – available 24/7/365 – while acting on more data points and with greater longitudinal consistency. That means higher quality care for more patients in need.

As the use of gen AI in healthcare expands into co-pilot and services as software, it has the potential to fundamentally transform the healthcare stack. Some questions remain, though. For instance, what if the data needed to engage consumers in better preventive care increasingly resides outside the clinical system of record? Is it the optimal model for payor AI agents and provider AI agents to ‘interact’ with each other via natural language? What changes are needed to healthcare data labeling in order to maximally unlock productivity gains from gen AI tools?

The post AI care delivery organization

So, who will be successful at implementing the modern care delivery technology stack? We have seen several key characteristics contributing to success – (1) the willingness to experiment; (2) high levels of patient intimacy; and (3) data governance and security.

Experimentation

One important characteristic in leading AI-forward teams is a willingness to experiment. There are an immense number of administrative (e.g., coding / billing) and sub-clinical (e.g., pre-visit preparation) activities that lend themselves well to AI use cases – and the best organizations encourage AI fluency and usage for all team members in finding ways to improve even basic tasks.

Qualified Health allows healthcare partners to build, test, deploy, monitor, and scale AI applications. They provide the tools to train and enable healthcare staff to use LLMs in an intuitive way to reduce mundane and repetitive work. Health systems adopt a single product which ingests a system’s data from multiple sources and utilizes an AI processing layer to deliver insights across a wide range of use cases of the provider’s choosing – all while maintaining appropriate AI governance and protecting patient data privacy.

Patient Intimacy

AI can offer personalized care that is superior to the human-centric status quo in driving better patient outcomes and satisfaction. The best healthcare organizations are going to deploy tooling to improve patient interactions on the back of more context, more knowledge, and a richer understanding of a patient’s needs.

Arine, a medication intelligence platform, uses advanced AI models to enable plans and providers to serve the right intervention to the right member at the right time. Arine leverages generative AI to automate high-volume, low-complexity medication-related care management activities. At the same time, its adaptive AI continuously enhances clinical precision by incorporating new evidence and real-world insights into its knowledge graph — ensuring recommendations remain current, relevant, and highly targeted. As a result, Arine drives industry-leading uptake rates – over 50% of Arine’s recommendations get implemented – to improve patient outcomes and reduce overall total cost of care.

Data Governance, Privacy, and Security

US consumers are comfortable with gen AI in healthcare but only when closely managed – over 50% are neutral or comfortable with gen AI use for note taking and clinical decision support, but ~80% are uncomfortable with standalone AI use for treatment plans and prescriptions. And, according to United States of Care polling, 75% of voters want transparency into how AI developers and the health care sector is using AI within patients’ healthcare experiences.

Contrary to popular practice – doctors prompting personal instances of ChatGPT – the best organizations set up secure environments, adhere to a set of consistent practices on the labeling and use of data, teach providers how to prompt or query in a way that minimizes misleading answers, and maintain robust audit and explainability standards.

CIOs seldom have the influence over front line clinicians to teach, train, and police these practices. The best approach is to create environments that protect patient data by default, provide tools that are aligned to deliver answers consistent with how physicians use them, and provide a common reference point for data governance.

Over the past seven years, Town Hall has invested in companies with the ambition to transform care for those poorly served by the US health care system. We have closely watched policy and technology trends for opportunities to change the dynamic for millions of patients. We see generative AI similar to the way we see total cost of care payments and population health – as a mechanism for transformation. In the case of generative AI, thinking about important health care services as software can serve as an unlock to access to care, to deeper patient touch points, to more appropriate utilization, and to happier providers and patients.

And this innovation is within reach. The building blocks of AI are more accessible than ever. Healthcare technology should no longer be considered distinct from healthcare services – the two are becoming so interwoven that they will effectively become one-in-the-same. That’s the Healthcare Services as Software paradigm. Leading care delivery organizations are going to use AI and technology in every step of the care journey; leading healthcare technology companies are going to deliver practice capabilities that would have required too much labor to execute.

We have observed how this can work in early 2025 but expect the examples we are seeing will quickly be dwarfed by tens, then hundreds, then thousands of new uses that emerge over the course of this year and next. If pointed the right way, this will be the first technology advancement that feels good to physicians and carries real benefits for millions of patients.